Artigos

Algorithmic Trading: The way you use Algo Equipment To possess Day Change

24 / 09 / 25Sentiment-Founded Change Steps cover to make trading decisions in line with the research of field sentiment, that’s, the brand new cumulative mood otherwise thoughts away from people on the a specific investment otherwise market. The newest sentiment of your own marketplace is constantly determined by the social media, news posts, financial reports, etcetera. These types of supply help to learn perhaps the sentiment is actually optimistic, bearish, otherwise natural, on the basis of that positions are carried out correctly. That said, algorithmic trading actually is the brand new saving grace of several investors which do not handle the brand new severe psychological pressure that comes with change.

Immediate 300 evista | Pick the Correct Algorithmic Exchange App

Condition measurements is yet another exposure management strategy you must use inside the the algo exchange tips. Because of the allocating an appropriate level of financing to every trade, traders is also remove its chance of losings and you may protect the total change finance. Which strategic means helps spread exposure across the private positions, generating a lot more stable productivity and you may suffered efficiency inside exchange portfolios. Trading algorithms perform because of a scientific means of viewing market research and you will executing positions considering pre-developed legislation. This type of automated possibilities procedure guidance inside the milliseconds to understand options and you may implement exchange conclusion. Generally, a trader have a tendency to find a certain strategy to deploy utilizing the algorithmic trade platform.

That it sensation have a tendency to results in worst real-globe efficiency, while the formula don’t comply with actual field conditions. Trend-following formulas focus on pinpointing habits within the investment speed actions and change in direction of based manner. That with such as moving averages, this type of formulas attempt to make the most of the fresh extension of an upward or down trend in the industry. Algorithmic trading is a form of trade that makes use of software (APIs) to help you trigger trading automation considering particular criteria, for example prices otherwise business style. As opposed to conventional manual trade, and this utilizes people decisions, algo exchange eliminates people mistake, allowing deals to be performed when criteria are satisfied.

Furthermore, suggest reversion values immediate 300 evista may be used that have technology signs growing short-term change steps according to the presumption one prices usually return on the suggest. Of these examining the change of traditional methods to progressive automatic exchange, the basics of discover algo trade functions as a crucial investment. It offers expertise on the principles from algorithmic trade, away from essentials in order to developing and you may deploying automated actions, deciding to make the change for the which growing land more accessible.

Information Formulas

Of these a new comer to algos, easier designs, including momentum trading, may be the very available means. Finviz is not an investing system — however it’s one of the recommended inventory tests and backtesting programs out there to have algo investors. TradeStation is amongst the finest networks to help people apply advanced and you can effective formulas. It has easy yet , powerful devices suitable for a variety of investors.

The one thing one books all round trading techniques ‘s the coded instructions, deciding in case your buyers’ and sellers’ criteria suits. TradingCanyon develops formulas and you can indicator scripts to help with investors after all accounts. Rating big probability change indicators to your own portable or any unit with your premium symptoms to the TradingView charting system.

The newest coding vocabulary to own TradingView is actually Pine Program, and you may Microsoft C# to have NinjaTrader. It’s smart to begin brief, 1st change having a restricted level of financing to minimize possible loss. Because you acquire feel and you may confidence in your approach, you could potentially gradually scale-up. Is even extremely important — playing with avoid-loss orders and you can mode limitations on the condition brands can safeguard against high loss, especially in volatile locations. Ultimately, , as numerous companies fool around with comparable actions, that may diminish profits throughout the years.

An industry founder, constantly a big organization, encourages an enormous quantity of trading orders for selecting and you will promoting. Securities and Replace Payment (SEC) had accepted electronic exchanges, paving the way in which for computerised Higher-Regularity Trading (HFT). Since the HFT is also perform trades as much as 1,100000 times quicker than just human beings, they quickly became extensive. During a period of date, the necessity for a quicker, more reputable (free of people feelings), and you may exact approach triggered the beginning of algorithmic exchange.

How to attract An enthusiastic Algorithmic Exchange Means

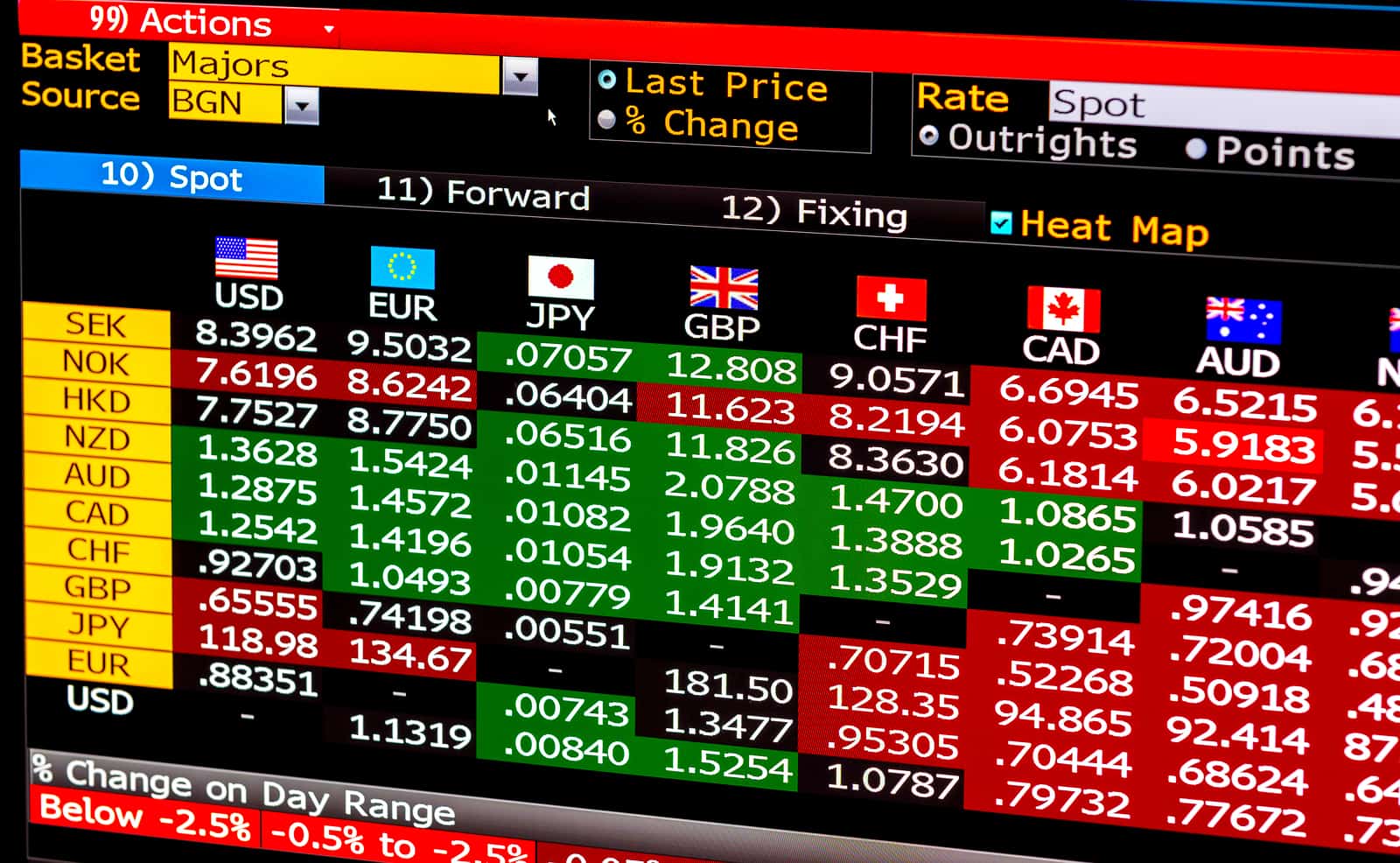

They run using the chief one to possessions undertaking better are likely to keep performing this for the short term, when you are poorly doing property can get persevere within decline. People have fun with symptoms such as the Cousin Electricity Index (RSI) or Swinging Mediocre Convergence Divergence (MACD) to guage trend electricity and you will select entryway and you may exit items. Speak about very important algorithmic trade procedures, as well as simple instances and key rules, to compliment their exchange degree and you will feel. Financial institutions and you may hedge finance are not implement algorithmic change to cope with highest profiles and increase performance top quality. Such possibilities take into account a substantial part of trading volume inside of several areas, especially in water instruments such futures, possibilities, and you can currencies.

- Visit QuantInsti to look at the new movies to your having fun with Python exchange spiders to backtest an investments method.

- I wish to mention and show what are the basic steps to get started with algorithmic trade.

- In this website, we’ll mention what exactly is algo trade, the way it works, and also the trick parts inside, for instance the networks, systems, and methods put.

- You can test a hundred tech symptoms to see those that would be to features a location on your algorithm after which examine how they manage against the SPY’s benchmark performance.

An enthusiastic AI which includes process such as ‘Evolutionary computation’ (which is motivated from the family genes) and deep learning you will find many if not a large number of hosts. As the moving in the future and overpowering options as they already been is exactly what we must do to get into so it domain name, we must comply with growing sciences such Servers Discovering. In the case of a long-identity take a look at, the goal would be to eliminate your order costs.

Exclusive people, that smaller tech-smart, can get pick able-generated change software due to their algorithmic trade demands. Algo change also offers a powerful equipment for you to speed up and you can improve date trade procedures, bringing pros including enhanced price, overall performance, and you may objectivity. Having best diligence and you may abuse, algo exchange will likely be an invaluable addition on the toolkit.

Rebate cost vary from $0.06-$0.18 and confidence the underlying security, if the trading are placed via API, along with your newest and you can previous day’s choices trade frequency. Options change involves extreme risk which can be maybe not suitable for all investors. Customers need comprehend and you can comprehend the Features and Risks of Standardized Alternatives ahead of provided one possibilities strategy. Certain state-of-the-art choices procedures carry additional exposure, for instance the possibility of losings which can surpass the first investment number, and so are only available to possess accredited users. Since the algorithmic exchange needs methods for making the extremely successful decisions, there are many different actions, for each and every according to some other industry standards. With advancements within the technology, algorithmic trading has been much more open to shopping people, unlocking a number of opportunities to cash in the industry.